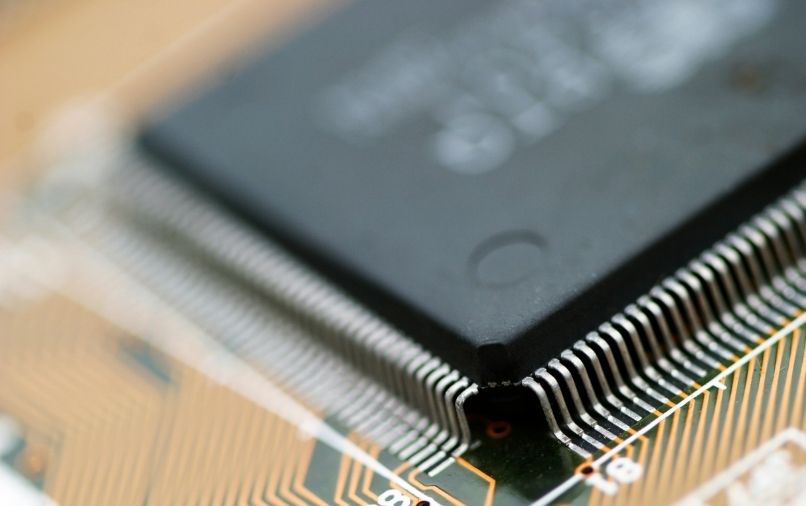

- STL Partners says that a shortage of semiconductors could impact device sales and service roll-outs across the telecoms industry.

- While shortages are said to be limited to certain categories of semiconductor, it is estimated that the situation will continue in the production chain into 2022 and 2023 until foundry capacity, substrates and component demand softens out.

- This situation became evident in the country at the beginning of the year when NBNCo cited supply chain issues for pausing new orders on its hybrid fibre-coaxial network.

New research from analysts STL Partners says that a shortage of semiconductors could impact device sales and service roll-outs across the telecoms industry. In addition, the accelerated digital adoption due to Covid-19 made a significant impact on supply chain and logistics due to the pandemic and increasing geopolitical tension.

According to the STL partners: “The ongoing semiconductor supply crunch has the potential to disrupt inventories for production of smartphones, routers and IoT devices, which in turn could impact device sales and service revenues for telecoms operators.”

They further added: “While shortages are said to be limited to certain categories of semiconductor, it is estimated that the situation will continue in the production chain into 2022 and 2023 until foundry capacity, substrates and component demand softens out.”

This situation became evident in the country at the beginning of the year when NBNCo cited supply chain issues for pausing new orders on its hybrid fibre-coaxial network. During this time, NBNCo pointed out that chip shortages were the reason for its inability to source terminals to support the HFC service.

STL Partners identified several trends currently impacting the semiconductor supply shortage, such as certain companies stockpiling chips.

“Apple is an example of how demand for consumer products is impacting component supplies. The company is one of the pandemic winners in terms of sales revenue and has experienced a boom in demand for its Mac, iPad, and 5G iPhone, which launched in late 2020,” the report said.

Still, according to the report released by STL partners: “Part of this success has been achieved through

its ability to avoid shortages by stockpiling critical components.”

STL Partners cited data from Susquehanna Financial Group and Bloomberg. According to the data, the ongoing shortage is expected almost to double the order-to-delivery times for chips. As a result, the deficit is expected from about 13 weeks in 2021 to some 20 weeks.

In parallel to this, the report also pointed to the direct impact on chip supplies of the ongoing US-China trade war. The placement of Semiconductor Manufacturing International Corporation on the US Entity List instantly forced chip consumers to seek capacity elsewhere. Semiconductor Manufacturing International Corporation is China’s largest foundry and the world’s 5th largest chip producer with 4% of the market.

As part of the report, STL Partners highlighted three-chip categories vulnerable to a tightening supply chain. These are sensor and microelectromechanical systems shortages, delays of analogue/radio frequency and mixed-signal systems, and the lack of microprocessors. All these could impact telecom businesses in the short term.

Loading...

Loading...